Jim Beam column:Flat taxes are growing fast

Published 6:16 am Wednesday, April 9, 2025

Louisiana, like many other states, wants to eliminate its income tax. Legislators moved in that direction during a third special session last year when they enacted a 3% flat individual income tax and a 5.5% flat corporate income tax.

In order to avoid a major budget shortfall, however, lawmakers increased the state sales tax to 5%. When local sales taxes are added, the state now has the highest combined sales tax in the country.

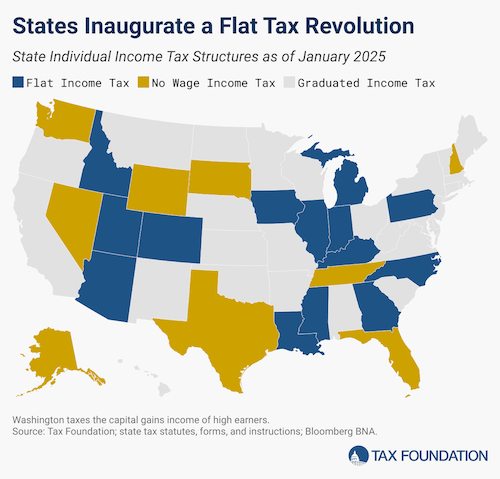

When Louisiana approved its flat income taxes last year, the Tax Foundation said it was part of a “state flat tax revolution.” The foundation said in the first century of state income taxation, only four states transitioned from a graduated rate to a single rate. Fourteen states have now moved to flat income taxes.

Congress passed the first American income tax in 1861 during the Civil War, but it was repealed in 1862. However, archives.gov said the concept didn’t disappear.

The 16th Amendment to the U.S. Constitution imposing a federal income tax passed Congress on July 2, 1909, and it was ratified on Feb. 3, 1913.

The Tax Foundation said flat taxes are meaningfully simple in several ways. They help state revenue forecasting and projecting the revenue effect of potential tax changes. And individuals and small businesses may be more attracted to a state with a relatively lower flat tax rate than one with a graduated-rate system, which Louisiana had.

The foundation added, “Of greater significance for taxpayers, however, is that flat-rate income taxes tend to function as a bulwark against unnecessary tax increases, and to provide greater certainty for individuals and business taxpayers.”

The Institute on Taxation and Economic Policy (ITEP) last November had a different analysis. It said the flat tax would worsen inequality “already rampant in Louisiana’s tax system while shortchanging essential services for families across the state.”

The institute said the flat tax would cut $1.3 billion a year from the state’s personal income tax and replace most of that loss with a higher sales tax.

“From 2021 to 2023, 26 states cut their personal and/or corporate income tax rates, and many of these states have little to show for it besides budget crises, struggles to fund public services and threats of downgraded credit ratings,” the institute said.

State Rep. Julie Emerson, R-Carencro, and chair of the House Ways and Means Committee, explained the goal of Louisiana’s tax changes to the Baton Rouge Press Club Monday, according to WAFB-TV. She said the end goal is to “eliminate your state income tax once and for all.”

The nine states without an income tax are Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming.

Investopedia said states with no income taxes typically don’t tax retirement income and may have lower property and sales taxes. However, high property taxes are the major difference in some of those no-income tax states.

Rocket Mortgage, for example, said Louisiana has the 5th lowest property tax in the country and New Hampshire has the 49th highest property tax of the no-income tax states. Texas had the 46th highest property tax.

Nevada is ranked as the 9th lowest property tax state. Tennessee is 15th lowest, Mississippi 16th lowest, Washington 23rd lowest, Florida 26th lowest, Alaska 31st lowest, and South Dakota 35th lowest.

Mississippi in a surprise move has passed a law eliminating its state income tax. However, news reports said the process of ending the tax could take as long as 14 years.

The wealthiest wage earners in Mississippi and Louisiana will benefit from flat taxes and lower income taxes. However, Louisiana’s Republican Gov. Jeff Landry last December said in his view, giving a bigger share of the tax cuts to big corporations and the wealthiest will produce an investment boom that will reverse Louisiana’s population losses.

Meta is building a $10 billion AI data center in north Louisiana. Hyundai is building a $5.8 billion steel plant in Ascension Parish. And Landry Tuesday announced another $4 billion plant is going to be constructed in Ascension.

The governor said, “I think it’s important for Louisianans to recognize how much we are winning. We are living up to the promises that we made when we started to focus on the businesses and industries that built this state.”

Things at the moment are definitely going Landry’s way.

Jim Beam, the retired editor of the American Press, has covered people and politics for more than six decades. Contact him at 337-515-8871 or jim.beam.press@gmail.com.

| ReplyForward

Add reaction |