Jim Beam column:Unpopular tolls are necessary

Published 6:54 am Saturday, August 26, 2023

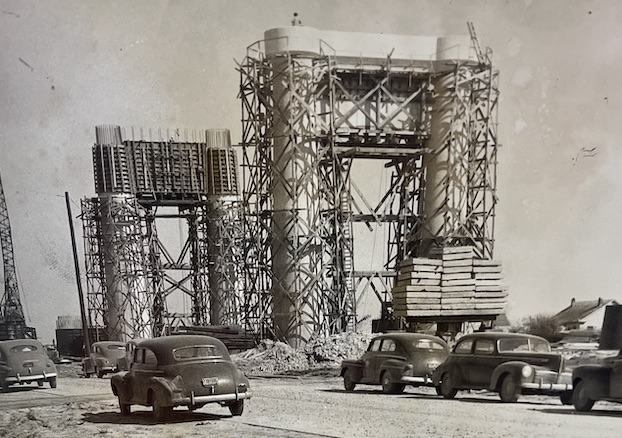

- Unpopular tolls are part of plans to build a new Interstate 10 bridge at Lake Charles..(Photo courtesy of Louisiana Department of Transportation and Development).

Nobody likes tolls, especially legislators who represent this part of the state. However, when you have a state Legislature that has refused to increase the gasoline tax for 33 years and that can’t wait to end the 0.45% sales tax increase of 2018, what are the alternatives?

The late-state Rep. Steve Carter of Baton Rouge had an excellent 2017 bill that would have raised the state’s 20-cent-per-gallon gasoline tax by 17 cents. It would have also been adjusted annually with the Consumer Price Index.

The House transportation committee approved the bill with a close 9-7 vote. Carter kept tabs on votes and returned his bill to the calendar when it came up for a House vote a second time, saying the votes weren’t there and he wasn’t going to force his colleagues to vote on the bill.

Trending

If the bill had passed, it would have raised $600 million annually. That would have provided $3.2 million for transportation purposes over the last six years. Federal matching money would also have been possible.

The National Conference of State Legislatures said since 2013, 33 states have enacted legislation to increase gasoline taxes. The U.S. Energy Information Administration said the average state tax on gasoline is 32.3 cents per gallon and many states have other taxes and fees on gasoline.

California has the highest state tax on gasoline at 68.1 cents per gallon. It is followed by Illinois, 66.5 cents: Pennsylvania, 62.2 cents; Indiana, 55.5 cents; and Washington, 52.8 cents.

When a temporary 1% state sales tax expired on June 30, 2018, legislators at a third special session kept 0.45% of that tax until June 30, 2025. It was projected to raise $500 million annually and continuing that tax would provide additional transportation money.

The odds are that isn’t going to happen. In fact, some candidates for governor said they want to cut taxes. A poll by The Advocate and six other organizations that was released Thursday showed only 4% of those surveyed are concerned about high state and local taxes. Crime and violence topped the list at 18%.

Now, back to the new bridge. The proposed tolls for trucks are definitely too high. There has to be some way to negotiate lower truck tolls before the current project is killed, as most area legislators appear to be suggesting.

Trending

Eric Kalivoda, secretary of the state Department of Transportation (DOTD), explained why that is a bad idea. He said if the Joint Legislative Committee on Transportation doesn’t advance the current plan in September, the bridge would be deferred indefinitely.

No PPP (public, private partnership) would want to do business here, ever, he said.

The Center Square reported that DOTD is exploring ways to minimize the impact of tolls on large trucks, including a potential tax credit for tolls beyond $3,000 a year. The department has also applied for a $200 million federal grant to buy down toll rates for non-local autos to lessen the potential impact on regional tourism.

These and any other changes, like decorative lighting and a bike and pedestrian lane, would require legislative approval.

Residents in this area have been waiting for a new Interstate 10 bridge here for much too long. To think that tolls are going to be the excuse for killing the current bridge project is unbelievable. Other solutions proposed by area legislators are “a day late and a dollar short.”

Half the states in the United States have toll bridges. New York is No. 1 with 16 toll bridges and it has toll bridge links to other states. The southern states with toll bridges are Alabama, Florida, Kentucky, Louisiana, Texas, Virginia, and West Virginia. Florida has 14 toll bridges, second highest number in the country.

Louisiana has tolls for the Highway 1 Expressway and Bridge, a total of nine miles. There are also tolls on the Lake Pontchartrain Causeway, the Avery Island Toll Bridge, and for the new Belle Chasse Bridge expected to be completed in April 2024.

Chris Landry, president of the Calcasieu Parish Police Jury and Mayors Nic Hunter of Lake Charles, Mike Danahay of Sulphur, and Hal McMillan of Westlake have the right solution. They have urged Gov. John Bel Edwards and the Legislature to continue dialogue and negotiations in order to find a path to tolls that are more reasonable.

It’s easy to blame others for needing tolls for bridge construction, but members of the Legislature have only themselves to blame. They have forfeited many opportunities to provide funding for a new Lake Charles bridge that should have been built years ago.