Jerry Adams looks back on three decades of preparing income tax returns

Published 10:04 am Wednesday, March 23, 2022

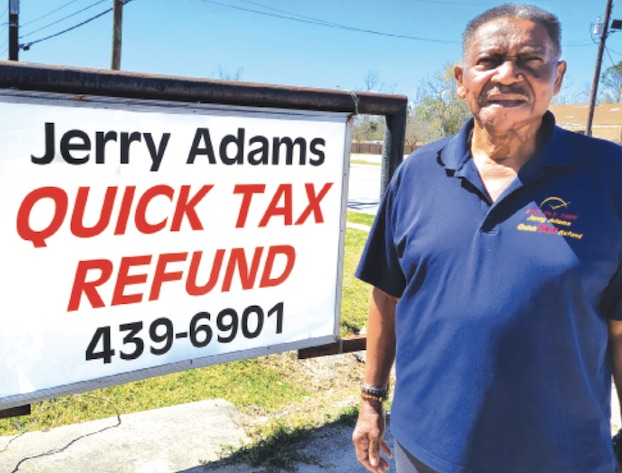

- Jerry Adams, with Jerry Adams Quick Tax Refund, taught mathematics and adult education for 43 years with the Calcasieu Parish School Board and did taxes for friends, family and coworkers as a side gig until he retired. (Rita LeBleu / American Press)

Jerry Adams, Quick Tax Refund, has been preparing income tax returns since 1971. He makes it easy, and clients can receive money the same day. When he started, he filled out forms in ink, made a copy on a xerox machine, stuck it in a manilla folder and filed it alphabetically, after sending the original by mail to the IRS. The client had to wait for his or her return to make it to their office, and wait for the check if there was a refund.

Today, everything is handled electronically. At Jerry Adams Quick Tax Refund, clients can choose from available options to allow them to get money that same day, an especially convenient benefit in a year when it’s been reported that the IRS is backlogged.

Of course, that’s not all that’s changed for Adams, who taught mathematics and adult education for 43 years with the Calcasieu Parish School Board and did taxes for friends, family and coworkers as a side gig until he retired.

“The standard deduction for a single person, head of household and married couple was $1,050 in 1971,” Adams said. And 1971 happens to be the first time the median family income for the United States went above $10,000.”

For 2021, the standard deduction is $12,550 for single and married couples filing separately, $18,800 for heads of household and $25,100 for married couples filing jointly. The estimated median income for 2021 is $79,900.

“The main thing about the current standard deduction is that fewer and fewer clients are itemizing.”

Adams shared topics of interest for taxpayers including child tax credit, earned income credit and the “real” deadline for filing taxes.

The child tax credit, normally up to $2,000 per qualifying dependent, was expanded to $3,000 per qualifying dependent child 17 or younger on Dec. 31, 2021 and $3,600 for children under 6, as part of the American Rescue Plan.

“Some single, married filing jointly or separately or head of households received this credit in advance. In other words, they received a monthly check. By now, all recipients of the advance child tax credit payments should have received a letter from the IRS breaking down any advance payments.

Did you receive too much? Not enough? The good news is, this money is not considered income, so it’s not taxed. Plus, taxpayers will not be required to pay back any excess child tax credit amounts if their adjusted gross income is at or below $60 for married filing jointly, $50,000 for head of household and $40,000 for single or married filing separately status filers.

The Earned Income Tax Credit helps low-to moderate income workers and families get a tax break. Those who qualify can use the credit to reduce the taxes owed. The earned income credit is for those who have worked and earned income under $57,414 (for someone filing as single, head of household, widowed or married filing separately with three children.) Investment income must be $10,000 or less.

“Because child advance tax credits aren’t considered income, persons who qualify for earned income credit will find that their number of dependents might increase the earned income credit,” Adams said.

Adams’ final tip has to do with the deadline for filing returns.

“You can file back taxes with the IRS at any time,” he said. “But if you want to claim a refund for one of those years, you should file within three years.”

•

Find out more, call Jerry Adams Quick Tax Refund at 337-439-6901.