Cassidy: Risk Rating 2.0 flood plan will cause rates to skyrocket

Published 12:37 pm Saturday, February 19, 2022

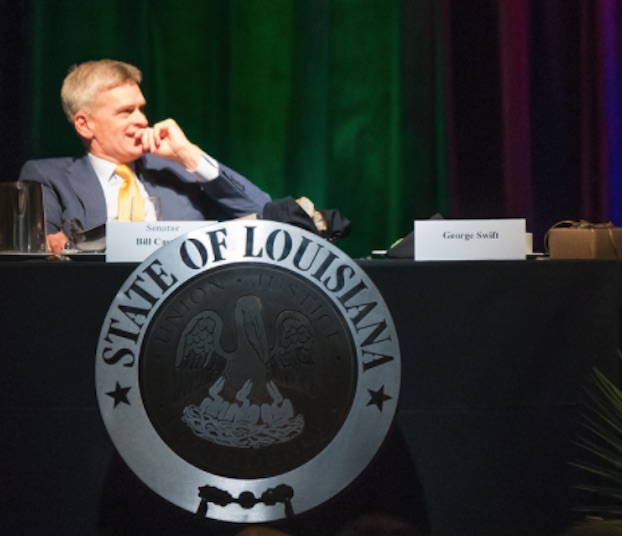

- U.S. Sen. Bill Cassidy, R-Louisiana, attends the LegisGator luncheon in Lake Charles. (Rick Hickman / American Press)

U.S. Sen. Bill Cassidy, R-La., said FEMA’s has confirmed the new Risk Rating 2.0 flood insurance plan would cause insurance prices to skyrocket for “the overwhelming majority of the population of Louisiana.”

The price increase was initially unconfirmed, though rumored, Cassidy said, but a recent letter from the agency confirmed the situation.

“Twenty percent of policy holders will drop out because the beneficiary can’t afford the premium…This is a problem because if they drop, you have spread the risk over a smaller amount of people,” he said.

Such an outcome would result in an “actuarial death spiral,” he said.

While the recent letter from FEMA is some progress, Congress is continuing to urge FEMA to release an official briefing on how the agency is calculating its new rates. By not doing so, “FEMA is not fulfilling its obligation to Congress or homeowners.”

Additionally, while legislators are working to find a solution, Cassidy said, “The White House can fix this.”

The White House, however, is still not doing its duty to address inflation, Cassidy said. “If you make the same amount this year that you did last year, you actually got an eight percent pay cut.”

The 40-year high inflation rate is eating the savings up of Americans due to the “expansion of government spending which is fueling it,” he said.

“It seems the administration is having a hard time solving the problem because they’re afraid of admitting they have one,” Cassidy added.

In other news, Fentanyl’s schedule one classification is set to expire on Friday. The drug is fueling the country’s opioid crisis “killing more Americans 18-25 than any other cause of death,” Cassidy said.

Cassidy and legislators are working to get a short-term extension of the classification included on this week’s continuing budget resolution. Preventing the expiration is “essential to saving lives,” he said.