Still time to apply for no-interest, 40 percent forgivable loan through Restore Louisiana program

Published 9:08 am Friday, October 25, 2024

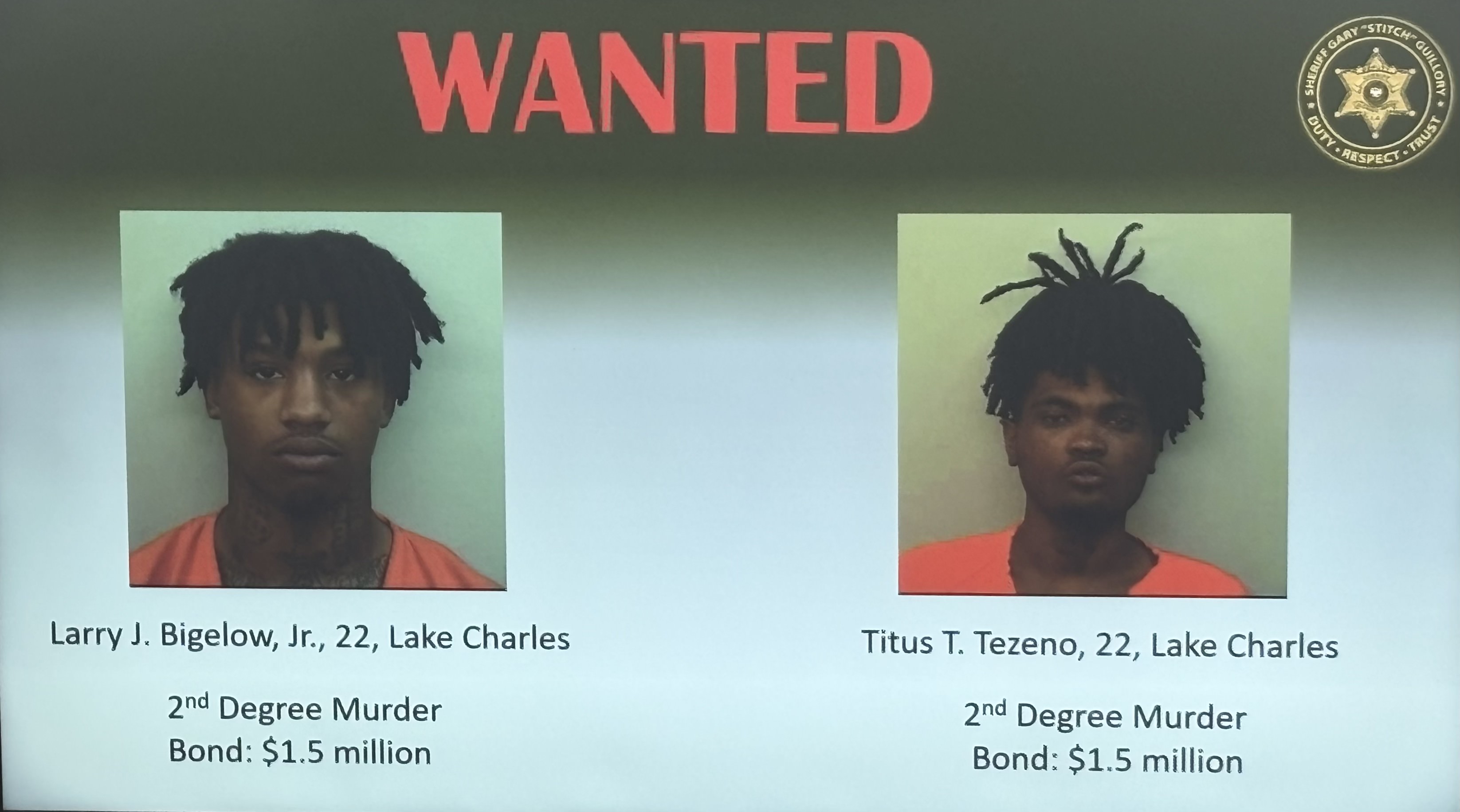

- Local business owner Mandeep Singh picked up his check from the Restore Louisiana Small Business Loan Program at the SEED Center Thursday. The program is administered through the Louisiana Office of Community Development, which partners with South Central Planning and Development Commission (SCPDC). Shown left to right are Mayor Nic Hunter, Singh, Woody Daigle, SWLA Regional Director and Veterans Affairs Liaison to U.S. Sen. John Kennedy and Dane Bergeron, SCPDC. (Rita LeBleu / American Press)

Five area business owners closed on no-interest, 40-percent forgivable loans Thursday. There’s more where that came from — $6 to $7 million more — for those who qualify, according to Dane Bergeron. Nonprofit companies may also apply.

But time is running out. The deadline is noon Monday, Dec. 30.

Bergeron is the assistant field manager from the South Central Planning & Development Commission (SCPDC) Restore Louisiana Small Business Loan Program. He’s been going around Allen, Beauregard, Calcasieu, Cameron, Jeff Davis and Vernon parishes, telling business owners and officials about the Restore Louisiana Small Business Loan Program.

“This was money from the Laura/Delta disaster, money from the feds that we fought a long time to get, and we finally got the allocation. It was a fair and equitable response,” said Lake Charles Mayor Nic Hunter. “And, I think we’ve got to be honest about that. Our delegation, our federal delegation, really did fight for us. It was a joint effort between the federal delegation and the governor. This is money we fought for. So we want to see it utilized.”

Approved applicants make no payments for six months and pay back 60 percent of the loan within seven years. There are no closing or application fees. Loans are $10,000 to $150,000, but an exception may allow up to a maximum award of $250,000.

Businesses or nonprofits must have been impacted by Hurricanes Laura or Delta. However, monies are not to be used for replacing or repairing structures, but for operational expenses, expenses not covered by insurance such as monthly rent or mortgage payments, monthly wages and benefits, monthly inventory and moveable equipment.

“Post Hurricane Katrina, the government was issuing grants and the grants were not being used as intended,” Bergeron said. “This way, applicants have skin in the game.”

SCPDC will follow up periodically with loan recipients. In the case of a violation, the loan recipient will pay back the full 100 percent plus the current interest rate on that amount.

“When you are battling for funding, your financials are scrutinized,” Bergeron said, by several layers. We are just doing the intake, gathering the information.”

Businesses have to have been in operation for a year with no name or owner change prior to the disaster with evidence of pre-storm revenue of at least #25,000 annual gross revenue. Businesses must have been operating at the time of the disaster and currently operating or be able to demonstrate the ability to reopen.

Businesses must have a minimum of one full-time employee (at least 35 hours a week), and not more than 50 employees.

Funding is through the Community Development Block Grant Disaster Recovery Program (CDBG-DR) from the U.S. Department of Housing and Urban Development.

To find out more, go to www.scpdc.org or call 1-800-630-3791 for center locations and hours.