Jim Beam column: Constitution is safe — for now

Published 6:15 am Wednesday, July 31, 2024

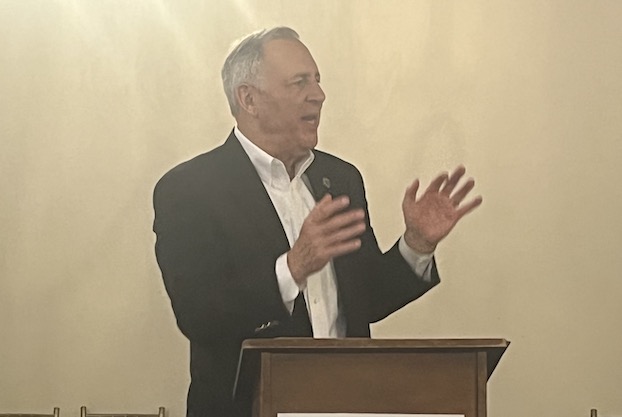

- Louisiana Senate President Cameron Henry, R-Metairie, has become one of the more sensible and practical members of the state Legislature.(Photo courtesy of WWNO public radio in New Orleans).

Louisiana citizens have apparently been spared the possibility that the state Legislature might meet for another special session this year to either write a new state constitution or just reform Article VII, the revenue and finance section of the constitution.

Senate President Cameron Henry, R-Metairie, who has become one of the more sensible and practical members among his 143 colleagues, gave us the good news in a recent report by The Advocate.

“It’s very unlikely we will have another session this year,” Henry said.

Trending

Lawmakers held a special session to create a second Black state congressional district that will be used for the Nov. 5 presidential and congressional elections.

Crime was the major focus of a second special session where legislators killed a number of bipartisan criminal reform measures enacted during the Gov. John Bel Edwards administration.

Then came the regular legislative session where Republicans enhanced the powers of GOP Gov. Jeff Landry.

One of those bills gave Landry the power to name the chairpersons of state committees and commissions that helped him name the new president of Northwestern State University in Natchitoches.

Landry has been a target of the state Board of Ethics, so lawmakers gave him control of appointments to the board, which means we will rarely see anyone be accused of ethics violations.

Legislators came awfully close to changing the state’s civil service system that protects the jobs of many state employees with a proposed constitutional amendment. The bill cleared the state Senate with a 26-11 vote, which is exactly the two-thirds needed. However, it fell eight votes short of the 70 needed in the House.

Trending

Looking back over what has transpired in the Legislature over the last six months, it comes as no surprise that the citizens of this state weren’t looking forward to Landry writing a new state constitution or changing the finance section of the existing one.

Richard Nelson, a former candidate for governor and the new secretary of the state Department of Revenue, is a strong advocate for rewriting the finance section of the constitution. Here are some of the things Nelson would like to see changed:

- Eliminate some of Louisiana’s more than 200 sales tax exemptions.

- Tax digital goods that consumers buy online.

- And expand the list of services that get taxed in Louisiana.

One of those major sales tax exemptions means citizens don’t pay sales taxes on food purchased for home consumption, home utilities and prescription drugs.

The late Rep. Vic Stelly of Moss Bluff put those exemptions in the state constitution in his 2002 tax reform plan, knowing citizens would be extremely reluctant to vote to give up those exemptions.

Nelson hasn’t said whether he supports removing those exemptions, according to The Advocate, but he wants to reduce the state’s personal and corporate income taxes.

When it comes to getting rid of state sales tax and other exemptions, current legislators would be wise to discuss their plans with former Republican state Reps. Stuart Bishop of Lafayette, Barry Ivey of Baton Rouge and Julie Stokes of Slidell. The three of them tried a number of times to eliminate tax exemptions and had little success.

Henry explained it well when he said, “We’ve made a lot of progress, but it’s a complicated issue that requires continued discussion. The public deserves time to see our plans and understand the implications for their families and their businesses. We want to get this right.”

Legislative leaders are planning to hold monthly hearings on taxes, insurance, transportation and education to educate the public on those issues so they can develop legislation for next year.

Since many members of the Legislature have given Landry most of what he wanted over the last six months, they may go along with some tax changes next year. However, any tax changes requiring voter approval are going to have tough sledding.

As we have reported before, 62% of the state’s registered voters rejected a 1992 constitutional amendment that would have authorized up to 10% cuts to all dedicated funds, except those for highways. They also rejected six other amendments and observers said that was because voters wanted to be sure they killed the right one.

The late-Govs. Buddy Roemer and Edwin W. Edwards and many legislators have learned over the years that tax reform is a tough sell.

Jim Beam, the retired editor of the American Press, has covered people and politics for more than six decades. Contact him at 337-515-8871 or jim.beam.press@gmail.com.