Jim Beam column: Insurance is voters’ nightmare

Published 6:31 am Wednesday, May 8, 2024

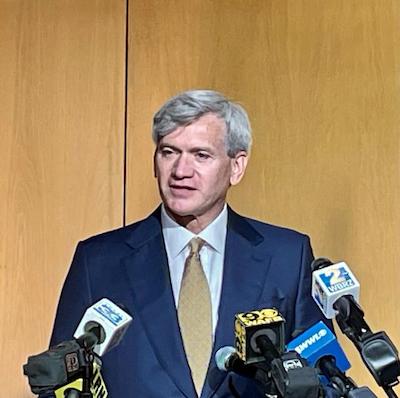

- Tim Temple, Louisiana's new insurance commissioner, has a legislative program that doesn't sit well with the state's property insurance policyholders.

No one should be surprised about a newspaper poll that shows Louisiana voters continue to be unhappy about the high cost of property insurance. Legislation has been filed that is aimed at fixing problems, but one of the most unpopular bills has already been approved.

Rep. Gabe Firment, R-Pollock, is sponsor of House Bill 611 that ends a state rule barring insurers from dropping policyholders after three years. The bill passed the House 72-32 and the Senate 26-9, both with more than two-thirds legislative approval, and it is awaiting the governor’s signature.

The Advocate in its report about the newspaper’s poll said, “Asked about one key change (Insurance Commissioner Tim) Temple pushed eliminating a long-standing and unique rule barring insurers from dropping policyholders after three years — 68% of voters said they disagreed with it.”

Temple is unknown to most voters and the poll showed “he is underwater with the ones who do know him — perhaps because they associate him with a crisis. Only 21% have a favorable opinion of Temple, while 28% have an unfavorable view.”

Also awaiting the governor’s signature is Senate Bill 295 by Sen. Heather Cloud, R-Turkey Creek, that makes rate increases automatically approved unless the commissioner rules otherwise within 30 days. It passed the Senate 35-0 and the House 93-3.

Ron Faucheux, whose company conducted the cellphone poll, said of the insurance poll’s findings, “When they have an opportunity to state an opinion, it’s pretty negative toward what’s going on. It was by far the biggest negative that the governor has right now.”

Real Reform Louisiana said, “Flanked by insurance lobbyists, Temple repeatedly testified on behalf of legislation that makes it easier for insurers to raise rates and cancel policies and harder for policyholders to file claims and hold their insurers accountable.”

The commissioner said, “I’m frustrated, too. That’s why I’m focused on solutions that will help Louisiana families and businesses by addressing the availability and affordability of insurance in our state.”

The Advocate correctly noted that even if Temple’s strategy does work, it could take years for homeowners to feel the effects. And it added that some analysts believe higher prices will continue because of rising climate risks.

As for Landry, those who were polled have said they disapprove of his handling of the insurance issue. That is by a 60% to 21% margin.

A Baton Rouge homeowner said her insurance premiums have skyrocketed. She added, “My salary is not doubling every year.” She thinks dropping policyholders is going to make the problems worse.

The homeowner said she would like to see leaders bolster Citizens, the state’s insurer of last resort, become a better safety net. The company has to charge 10% more for premiums than those in the private sector, but an effort to lower that percentage has already failed.

The Louisiana Illuminator on April 4 reported that a bill by Rep. Matthew Willard, D-New Orleans, stalled in the House Insurance Committee with a 9-9 vote. It would have reduced that 10% surcharge to 5%.

Willard said many homeowners cannot get any private companies to write policies on their homes and said he was concerned that Temple’s legislative package won’t provide any relief in the near future, if ever.

The state House took one major step when it approved the state’s $48 billion budget that includes $15 million for the state’s Fortified Roofs program as requested by Landry’s administration.

The Advocate reported back in April that state officials have said building roofs to specific hurricane-resistant standards — “as perhaps the soundest long-term solution to Louisianans’ insurance woes, since they should result in cheaper premiums.”

Sen. Rick Talbot, R-River Ridge, and chairman of the Senate Insurance Committee, defended ending the three-year policy rule, saying it discourages insurance companies from coming to Louisiana. However, he continues to say fortified roofs that give policyholders $10,000 to construct those roofs are a better solution.

Talbot wants permanent funding for fortified roofs.

“In Alabama, where they have more fortified roofs than any state, they’re seeing 20%, 30%, 35% premium reductions just for putting that roof on,” Talbot said.

Unfortunately, fortified roofs are the only optimistic news for now about insurance changes in Louisiana. Other solutions could take years to lower premiums and policyholders want quicker results.

Jim Beam, the retired editor of the American Press, has covered people and politics for more than six decades. Contact him at 337-515-8871 or jim.beam.press@gmail.com.

| ReplyForward

Add reaction |