Local financial institution keeps growing

Published 7:00 pm Tuesday, February 20, 2018

Big banks are closing branches throughout Southwest Louisiana. Lakeside Bank, on the other hand, continues to grow.

Mike Harmison, Lakeside president and CEO, recently highlighted industry trends and how depositors could get interest on Lakeside Bank’s three- and five-year CDs upfront.

“Last year, Capital One closed 32 percent of its branches,” said Mike Harmison, president and CEO of Lakeside Bank. “SunTrust, which doesn’t have a presence here, closed 22 percent of its branches, and Region, found in the Baton Rouge area, closed 12 percent of its branches.”

Harmison has been observing banking trends since he entered the industry in the ’60s.

“At the time, there were 15,000 banks, not branches – banks” Harmison said.

The 1980s saw that number explode to 16,000. Contrast that to the latest report from the FDIC, which reports the number of banks in the U.S. is down to 5,700.

“If you look at all the bank closures, we’ve had more banks close since 2008 and 2009 –— the time of the great recession — than the time of the Great Depression,” Harmison said.

When it comes to banking and government, Harmison believes bigger isn’t always better.

Twelve banks – 0.2 percent of all the banks in the U.S. – control 70 percent of the banking assets in the country, according to Harmison.

These Goliaths are gobbling up smaller banks, eliminating competition and they’re closing branch doors in an effort to further increase profits.

Lakeside Bank, however, has a very different story. In 2009, its charter was the only one of its kind approved during a time when government regulations stymied the growth of new community banks. It enjoys the distinction of being only one of two truly local community banks in Calcasieu Parish.

“Community banks control only 20 percent of the country’s banking assets,” Harmison said, “yet they make 80 percent of the agriculture loans and 60 percent of the small business loans.”

Lakeside Bank continues to grow because it helps fuel the start of new businesses and growth of existing local businesses. Lending is flexible. Local lenders look at the local picture and the big picture. Contrast that with a loan application at a big bank. Information goes to a decision maker miles away who knows little about farming, ranching, housing demand or serving the petrochemical industry. Even if the loan is approved, the applicant could miss out on an important window of opportunity waiting to hear back from the corporate office.

Lakeside Bank is opening branches. Its newest branch is located in Sulphur on Maplewood Drive, bringing its total number of offices in Southwest Louisiana to four.

“We will continue to expand our footprint where we see a need to serve the community,” Harmison said.

Lakeside Bank’s personal banking products and services also help fuel the local economy. Enjoy the benefits of the new three- and five-year CD, which could pay 100 percent interest earnings up front.

“We’ll give you three or five year’s of interest earnings up front. No waiting to maturity. Use that income now or re-invest it now” Harmison said.

Open up a low-fee, no-fee or interest-accruing account. Lakeside Bank customers enjoy access to any ATM without paying any fees.

Harmison said Lakeside Bank is offering consumers and businesses a banking experience based on long-term relationships and a commitment to continue to grow and prosper the local economy for the benefit of those who call Southwest Louisiana home. “It’s our home too.”

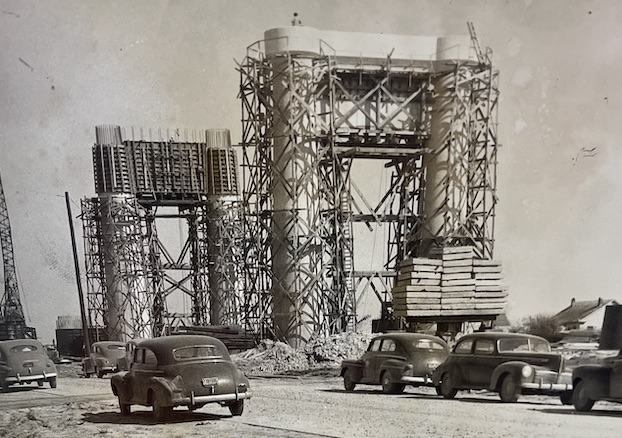

Lakeside president and CEO Mike Harmison said Lakeside will continue to expand its footprint. Shown above is an architectural rendering of what the new Sulphur Lakeside Bank branch will look like when completed.

The bank’s temporary location in Sulphur on Maplewood Drive near Shasta Drive. This building will be used until the new bank is complete.

Lakeside is adding branches. Big banks have been closing branches, including the Capital One branch that was located in the building shown above.